|

Benefits Of Cost Segregation |

| |

|

Primary Benefits:

|

| 1) Significantly increased Cash flow and ROI on property. |

Rather than 39 or 27.5 year straight-line depreciation, you take 5, 7 or 15 year declining-balance depreciation. Approximately 60% of the benefit is available in the first two years, thus significantly lowering your tax payments.

|

| 2) Immediate benefit in Quarterly Tax filings. |

You may proportionately reduce your next quarterly payments to

the IRS.

|

| 3) When your roof, HVAC unit or other building components

need replacing, you can write-down remaining book value. |

Most of the time, this can only be done if a Cost Segregation study has

been performed. Sometimes, this benefit, alone, makes a study worthwhile.

|

|

|

|

Typical Example:

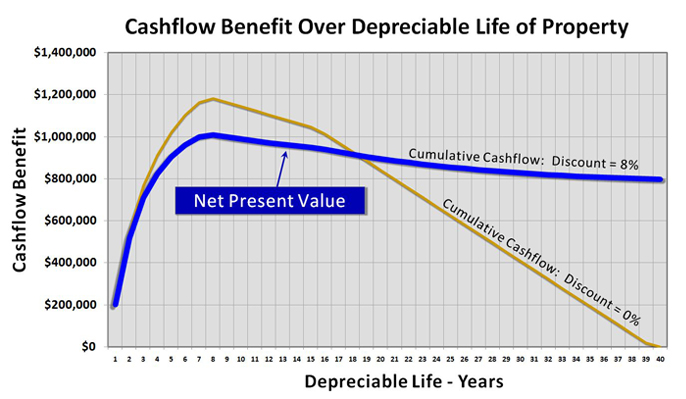

A recent AEON client with a $10 Million property was able to realize a $740K increase in cash flow in the first 3 years and a fully discounted $800K over the 39 year depreciable life of the property. This amounted to a windfall 9% incremental return on the property! This result is highly typical of all AEON studies.

|

|

|

|

| |

|

|